Hopes for a quick rebound from the worst bout of market volatility in years were dashed as the specter of a spiraling global trade war pummeled equities while Canada’s dollar was hammered.

US stocks buckled again after Donald Trump’s latest trade-war salvo against Canada, with the S&P 500 sliding to within a whisker of a correction and mega cap technology resuming a selloff that has wiped out trillions in value.

The US president said Tuesday he would double steel and aluminum tariffs on Canada to retaliate against Ontario’s move raising taxes on electricity sent to the US, ramping up his fight with the US’s largest trading partner.

It’s been a dizzying turn of events for investors accustomed to years of US tech gains and a resurgent dollar, and traders are looking to bonds and currencies around the world to escape.

I get it; things are upsetting right now on many levels. To me it feels like my best friend stabbed me in the back. The uncertainty is hard to take as well as all the actions the US government is taking right now – on so many levels. I worry about the future especially for my kids.

On the other hand, I’m proud of how Canadians are sticking together and being strong. I’m happy this has brought out the patriotic side of our country, so that is positive.

In terms of investments, what can we do?

The first is to not panic. Market fluctuations are a natural part of investing. While short-term headlines often amplify concerns, history has shown that markets recover and grow over the long run. Successful investing is not about avoiding volatility but managing it with discipline, patience, and a well-structured plan.

Here are a few key points to keep in mind:

- Volatility is Normal: Market pullbacks happen regularly, but they are often followed by periods of growth. Historically, downturns have been temporary, while long-term progress has been steady, like a yoyo on an elevator

- Stay Focused on Your Goals: Your portfolio is designed with your long-term objectives in mind, balancing growth potential with risk management. Reacting impulsively to short-term market movements can be counterproductive.

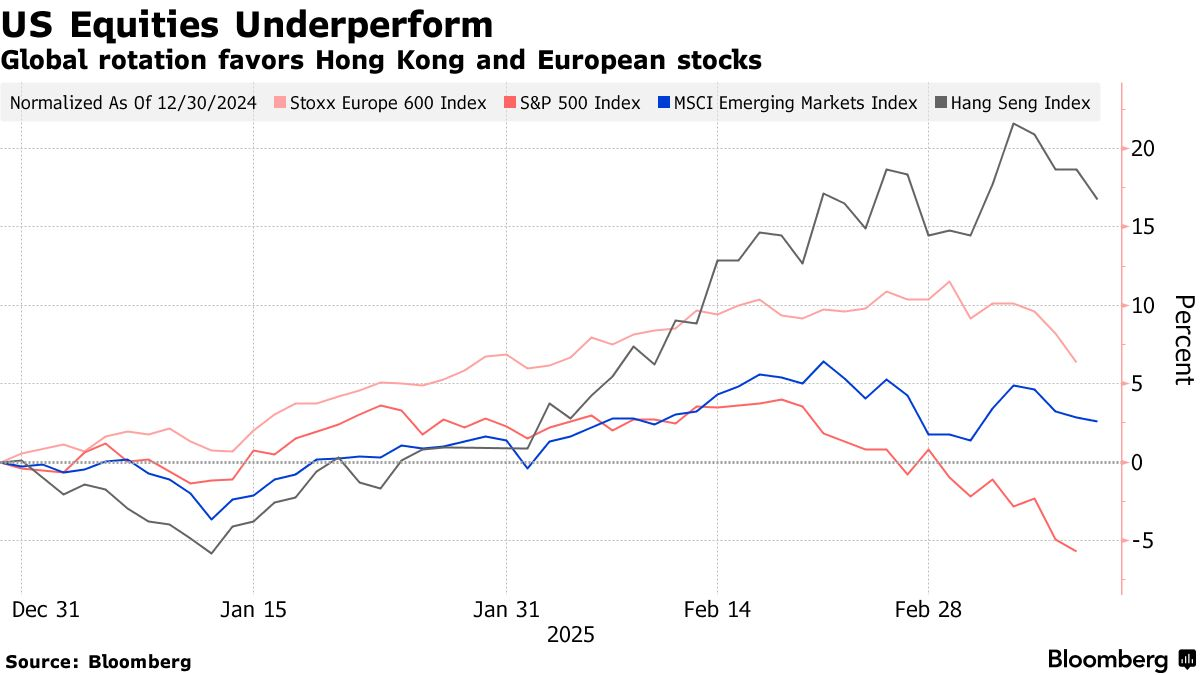

- Diversification Matters: A well-diversified portfolio helps cushion against market swings, ensuring you’re not overly exposed to any single investment or sector. Fortunately for us, we don’t have any clients that are all in stocks. Most of us also own bonds and private investments, so when the market is down a lot, you are likely down much less, or may still be up. We also invest across the globe, not just North America and from the initial chart you can see that other than the US, other investment markets are positive for the year.

- Opportunities Arise in Volatile Markets: Market corrections can present opportunities to invest at more attractive valuations. Staying the course often rewards patient investors.

- We Are Here for You: If recent market moves have you concerned, let’s discuss your portfolio and long-term strategy. We can review your plan, answer any questions, and ensure your investments remain aligned with your financial goals.

While market volatility can be unnerving, staying disciplined and maintaining perspective is key. If you have any concerns or would like to discuss your portfolio, please don’t hesitate to reach out.

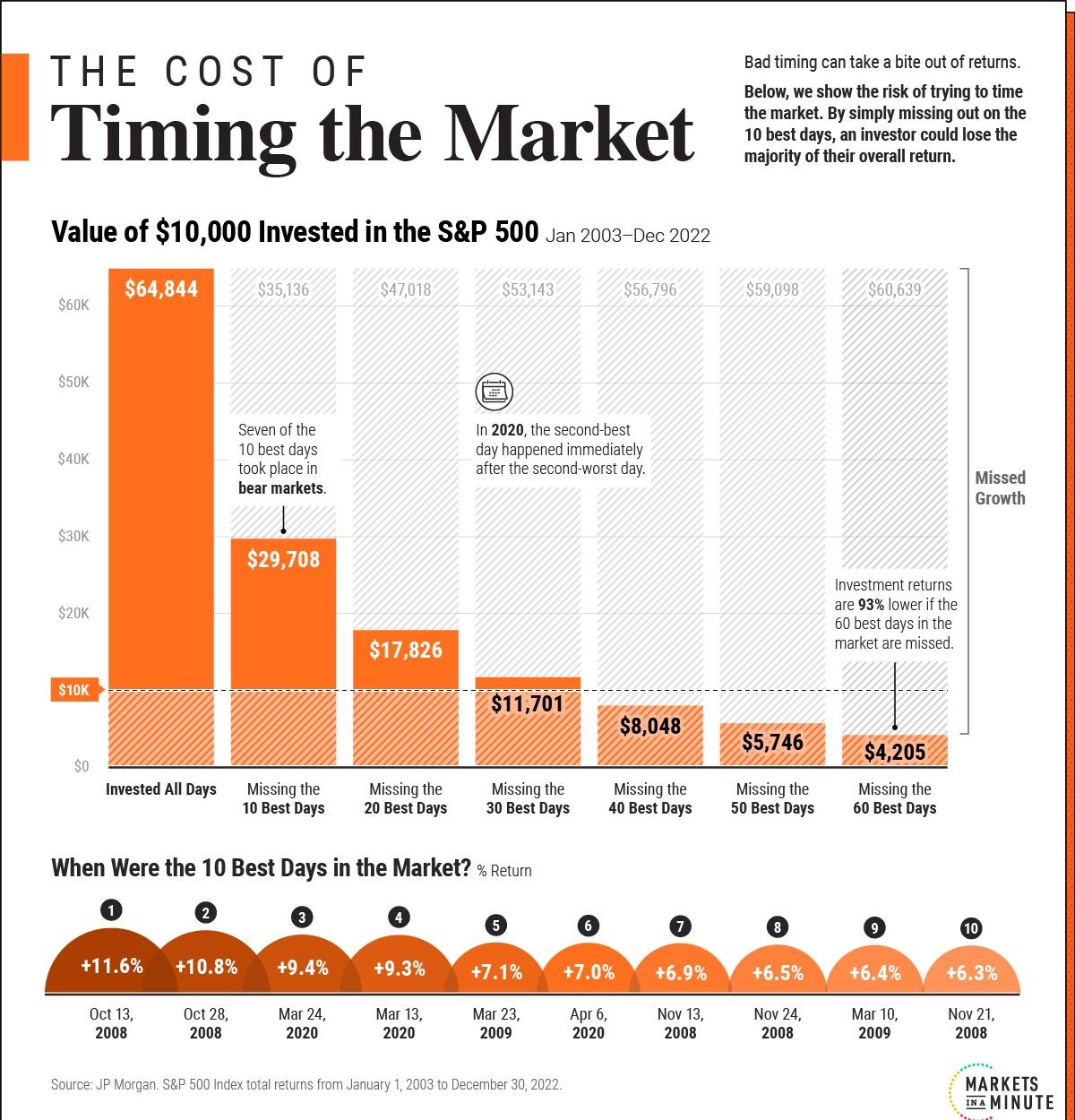

This shows what happens if you miss even a few of the best days of the market:

Sources: www.bloomberg.com

1 Chart: Bloomberg

2 Chart: JP Morgan