What do NVIDIA, Alphabet, and Microsoft have in common?

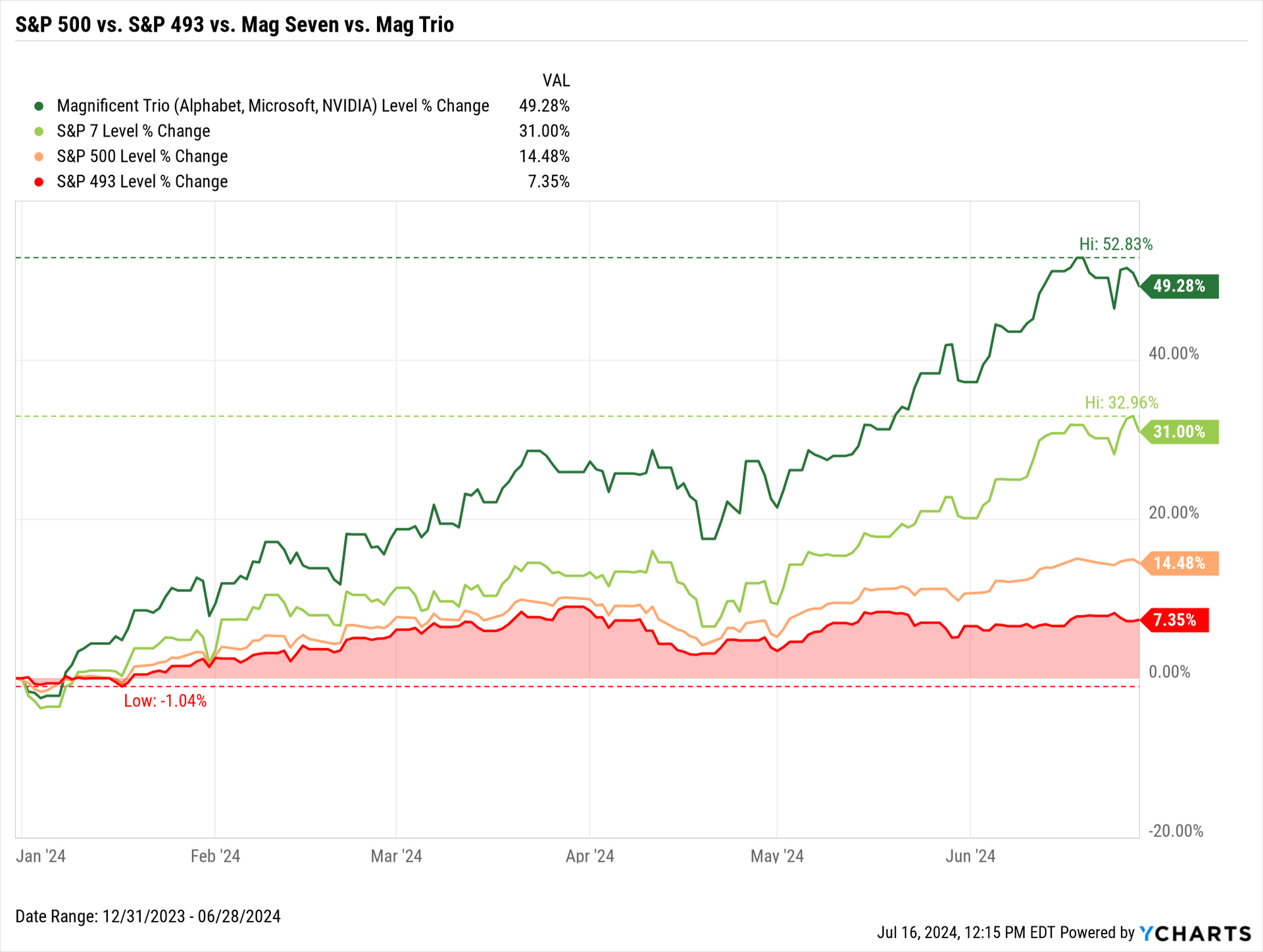

Maybe you have heard of the "Magnificent Seven" stocks. We're talking about Apple (AAPL), Amazon (AMZN), Alphabet (GOOG, GOOGL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA). Collectively, these seven companies are up 31% in the first half of 2024, compared to a modest 7.4% for the rest of the S&P 500, often dubbed the "S&P 493."

The overall S&P 500 has risen by 14.5% so far.

But here's the kicker: NVIDIA, Alphabet, and Microsoft alone have surged by 49.3% from January to June 2024, adding around $2.85 trillion in market cap. This means these three companies contributed to 49% of the S&P 500’s total market cap gains, which amounted to $5.8 trillion in the first half of the year. Collectively, the Magnificent Seven stocks accounted for 64.3% of the S&P 500’s market cap growth.

So, with these large-cap stocks growing even larger, it raises a big question: How concentrated is the U.S. stock market, and will these few names continue to dominate the broader indices?

Let's break it down a bit more. The biggest winner among the Magnificent Seven was NVIDIA, skyrocketing 150% in the first six months of 2024 and surpassing a $3 trillion market cap for the first time, joining Apple and Microsoft in the $3 trillion club as of June 5, 2024.

On the flip side, Tesla was the only one in the group that performed negatively, dropping 20.4% and losing $159 billion in market cap.

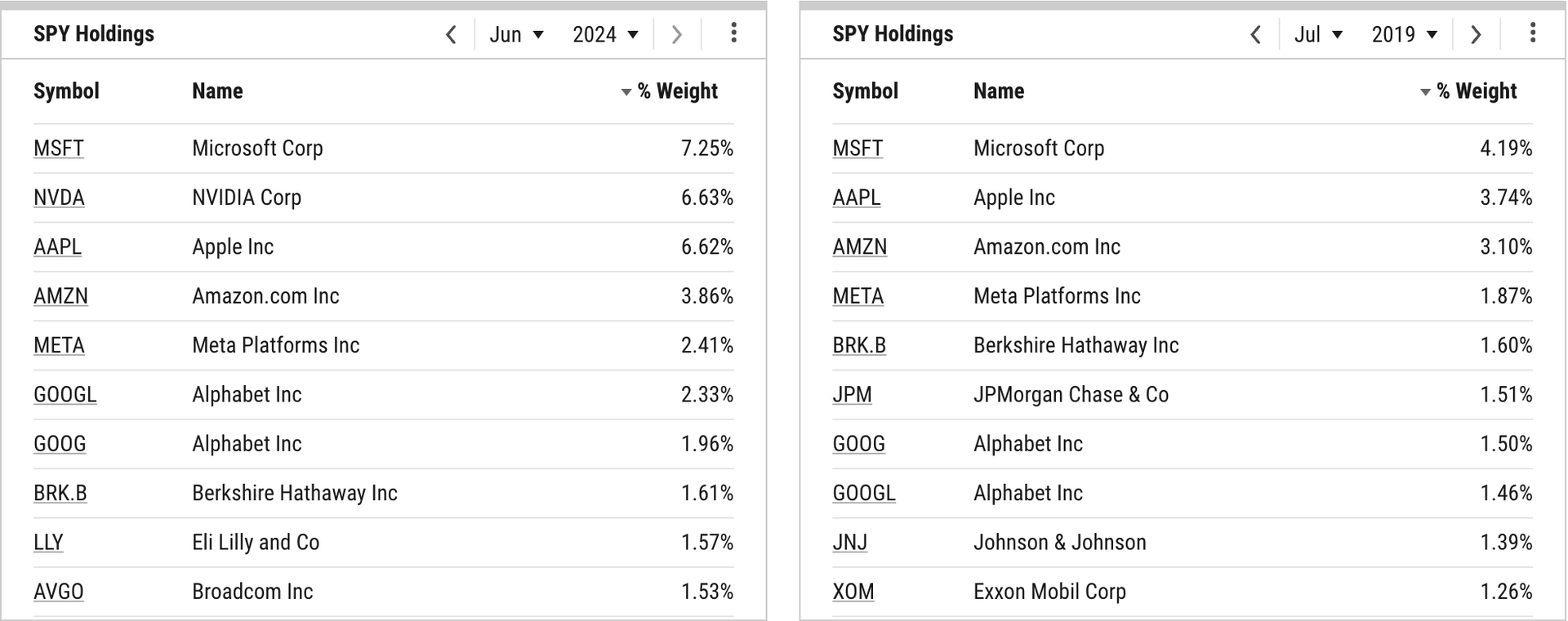

As of June 2024, the top 10 stocks make up 35.8% of the entire U.S. stock market. Looking back, the S&P 500 has become more concentrated at the top over the last five years. For instance, in June 2019, the top 10 stocks represented 21.6% of the index, but now six of those names have remained in the top 10.

When comparing market cap-weighted indices to equal-weighted ones, the concentration becomes more apparent. The S&P 500 is a market cap-weighted index, meaning each stock's weight is based on its total market cap.

Advantages of a Market Cap-Weighted Index:

- Reflects the overall market movements and investor sentiment.

- Requires less frequent rebalancing since the market naturally adjusts the weights.

Disadvantages of a Market Cap-Weighted Index:

- Poses concentration risk where a few large companies can dominate the index.

- Exhibits momentum bias, allocating more to stocks that have risen in value, which can mean buying high and selling low.

For those looking to diversify, alternatives like the Invesco S&P 500 Equal Weight ETF (RSP) offer a different approach. The performance of RSP versus SPY (the SPDR S&P 500 ETF) for the first half of 2024 shows how equal-weight funds can limit exposure to dominant stocks like the Magnificent Seven, although this strategy has had mixed results in limiting downside over the past five years.

Below is a Scatter Plot and table showing the first half of 2024 returns for each of the Magnificent Seven stocks, along with the S&P 500, in addition to their respective market capitalizations as of the end of Q2:

Will the U.S. stock market become more concentrated?

Historical trends suggest it could. The S&P 500’s concentration among the top 10 stocks has doubled over the last decade, with a significant acceleration in recent years. To hedge against the risk of over-concentration, consider investing in an equal-weight fund or index with reduced exposure to mega-cap names.

Represented by SPY, the SPDR S&P 500 ETF, the top 10 stocks comprised 21.6% of the index as of June 2019. Six names have been in the top 10 for the last five years:

This strategy can help avoid "putting all your eggs in one basket," providing some protection if any of these major companies face downturns.

Source: https://get.ycharts.com/resources/blog/how-3-stocks-drove-half-of-the-us-market-gains-in-1h-2024/#:~:text=However%2C%20NVIDIA%2C%20Alphabet%2C%20and,of%20the%20index's%20total%20gains.

Follow Us

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and a business name under which iA Private Wealth Inc. operates.

This is not an official website or publication of iA Private Wealth and the information and opinions contained herein do not necessarily reflect the opinion of iA Private Wealth. The particulars contained on this website were obtained from various sources which are believed to be reliable, but no representation or warranty, express or implied, is made by iA Private Wealth, its affiliates, employees, agents or any other person as to its accuracy, completeness or correctness. Furthermore, this website is provided for information purposes only and is not construed as an offer or solicitation for the sale or purchase of securities. The information contained herein may not apply to all types of investors. The Investment Advisor can open accounts only in the provinces where they are registered.

Products and services provided by third parties, including by way of referral, are fully independent of those provided by iA Private Wealth Inc. Products offered directly through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund, subject to exception. iA Private Wealth Inc. does not warrant the quality, reliability or accuracy of the products or services of third parties. Please speak to your advisor if you have any questions.

All Rights Reserved | Right Direction Financial

Proudly built and managed by Sommer Digital Inc.