How will the US election results impact your investments?

With the US election day over, many are reflecting on what this new leadership might mean for their financial investments. Many Canadians are not happy about the results. However, for our investments, its important to remember that stock markets have been influenced more by economic fundamentals than by which party is in power.

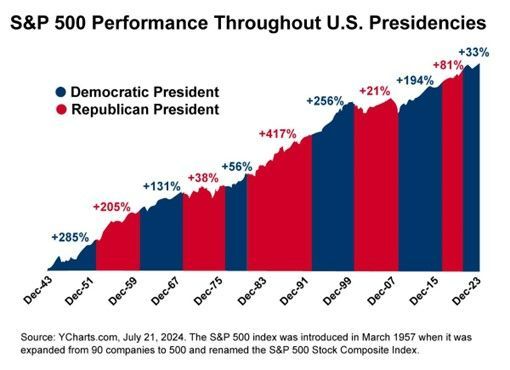

As this chart shows, while the stock market has fluctuated under presidents of both parties, the S&P 500 has trended higher over the long term, no matter who’s sitting in the Oval Office

● Long-Term Trends: The stock market, as represented by the S&P 500, has generally trended higher over the long term, regardless of which party holds the presidency.

● Company Growth: The dynamic U.S. economy has consistently produced successful companies, contributing to economic strength under various administrations.

● Market Priorities: Factors like earnings growth, economic conditions, and technological advancements can have more influence on market performance than political changes.

● Investor Focus: Your investment strategy should align with your goals, time horizon, and risk tolerance—not the outcome of a single election.

Some predictions (and remember most predictions are wrong) are that under a Trump presidency the US economy should be strong because there will be less regulation and lower taxes. However, with increased tariffs, costs will likely increase as will inflation, interest rates and the US dollar.

While elections do have consequences, it’s important to try to keep perspective. We will be closely monitoring how the new administration's agenda might impact areas like tax policy, regulations, and corporate competitiveness. Market reactions to political shifts can create short-term volatility, but these fluctuations can be temporary.

As always, the key is to stay focused on your financial goals. Sudden moves in response to short-term events might be more detrimental than beneficial. We’re here to help you navigate any uncertainty while pursuing your overall financial strategy.

If you have questions about how current events could impact your investments or want to discuss your financial strategy, feel free to reach out.

Here are the market returns to Nov 7:

Market:

YTD S&P 500 (US): 25.2%

TSX/S&P (Canada): 18.6%

Source: Bloomberg.com

Follow Us

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and a business name under which iA Private Wealth Inc. operates.

This is not an official website or publication of iA Private Wealth and the information and opinions contained herein do not necessarily reflect the opinion of iA Private Wealth. The particulars contained on this website were obtained from various sources which are believed to be reliable, but no representation or warranty, express or implied, is made by iA Private Wealth, its affiliates, employees, agents or any other person as to its accuracy, completeness or correctness. Furthermore, this website is provided for information purposes only and is not construed as an offer or solicitation for the sale or purchase of securities. The information contained herein may not apply to all types of investors. The Investment Advisor can open accounts only in the provinces where they are registered.

Products and services provided by third parties, including by way of referral, are fully independent of those provided by iA Private Wealth Inc. Products offered directly through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund, subject to exception. iA Private Wealth Inc. does not warrant the quality, reliability or accuracy of the products or services of third parties. Please speak to your advisor if you have any questions.

All Rights Reserved | Right Direction Financial

Proudly built and managed by Sommer Digital Inc.