Investing during volatile times can test your discipline and commitment, but there are some timeless principles that can help you stay focused on the long term and ease your mind.

Here are five key strategies:

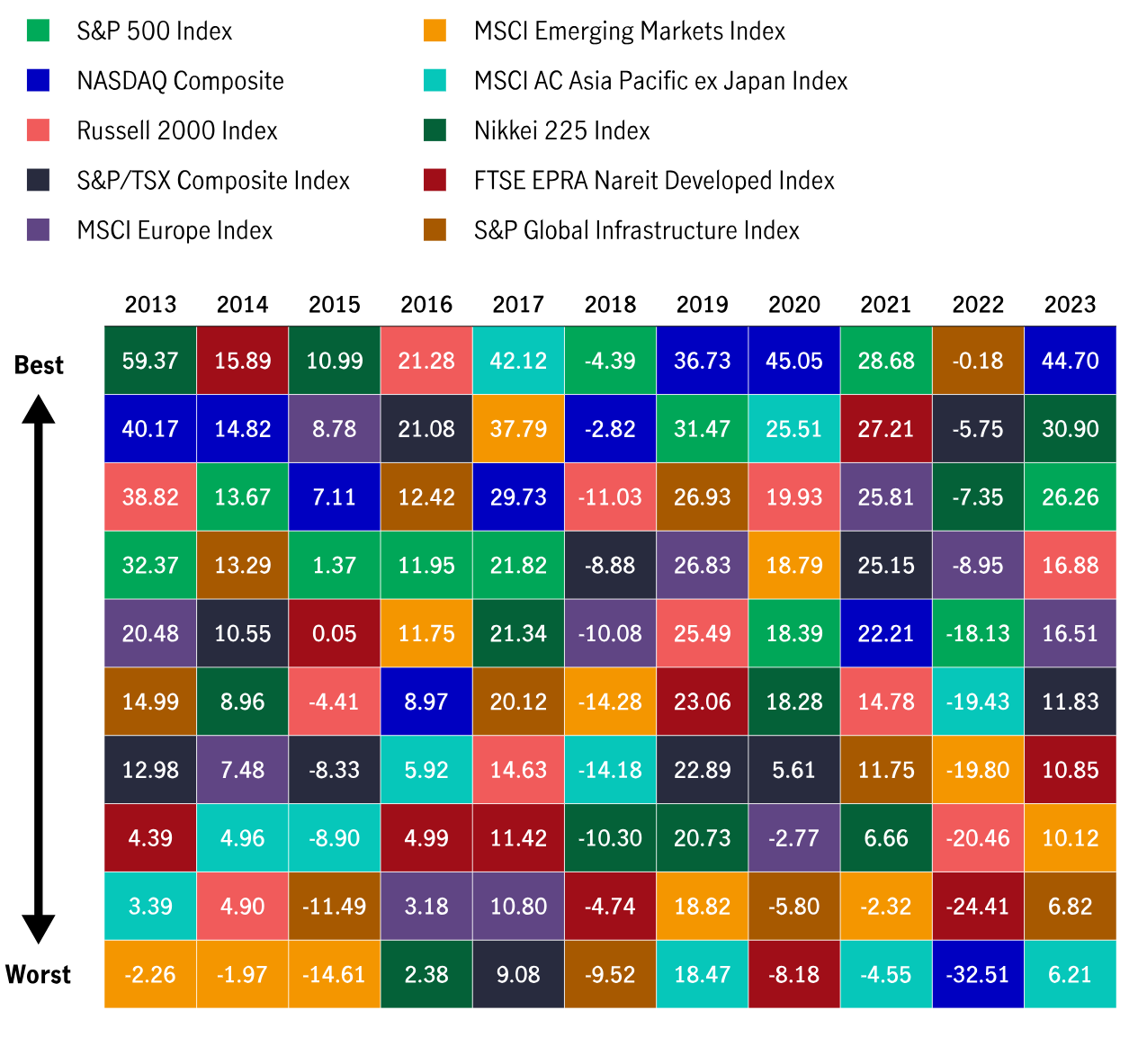

1. Think Diversification

It's uncommon for any single investment to consistently be a top performer year after year. By diversifying your investments across different economies, industries, countries, and asset classes, you can spread out the risk. This helps keep your portfolio more stable and reduces the impact of any underperforming assets.

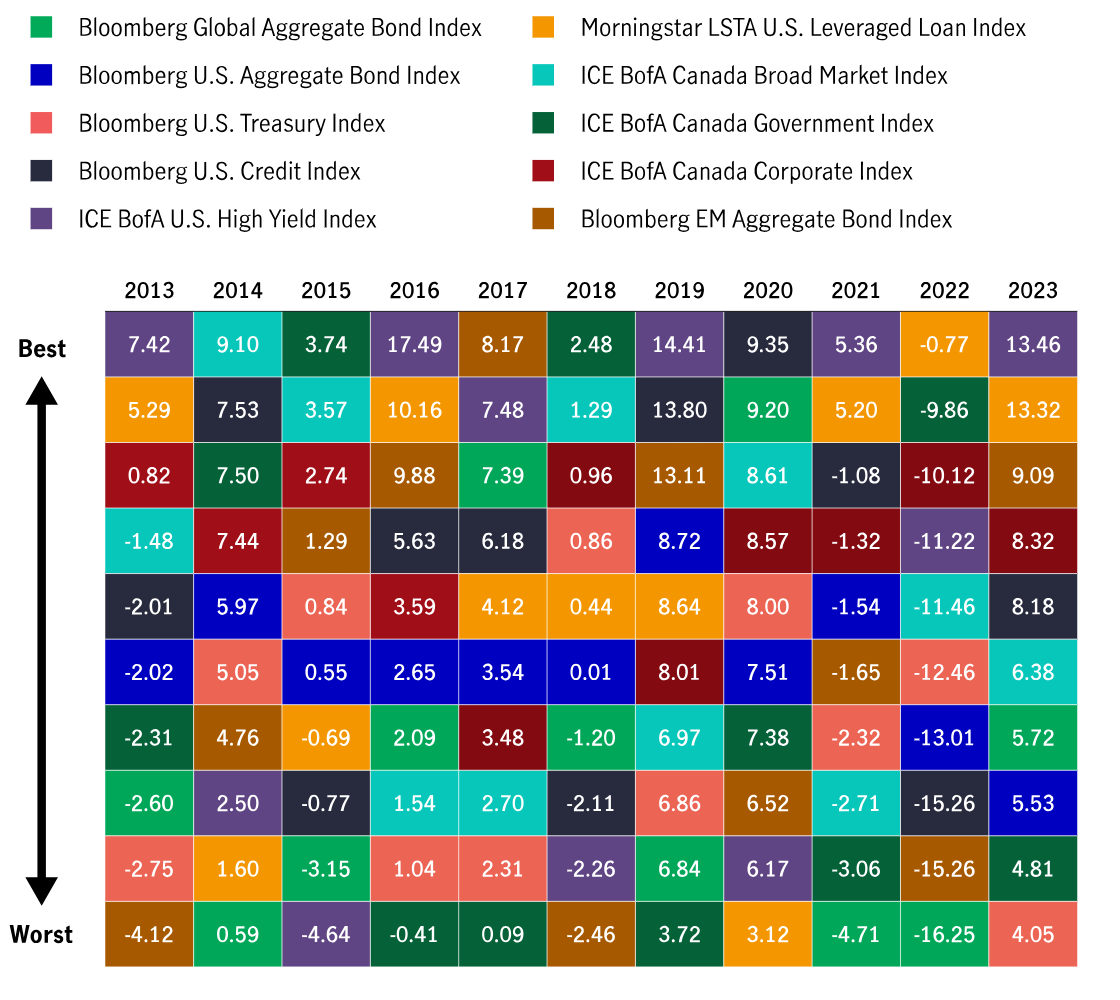

Historical asset class rotation, 2013–2023

Calendar year total returns by class assets (%)

Source: Manulife Investment Management, Bloomberg, as of December 31, 2023. Total returns are shown in local currency or in USD for multimarket indexes.

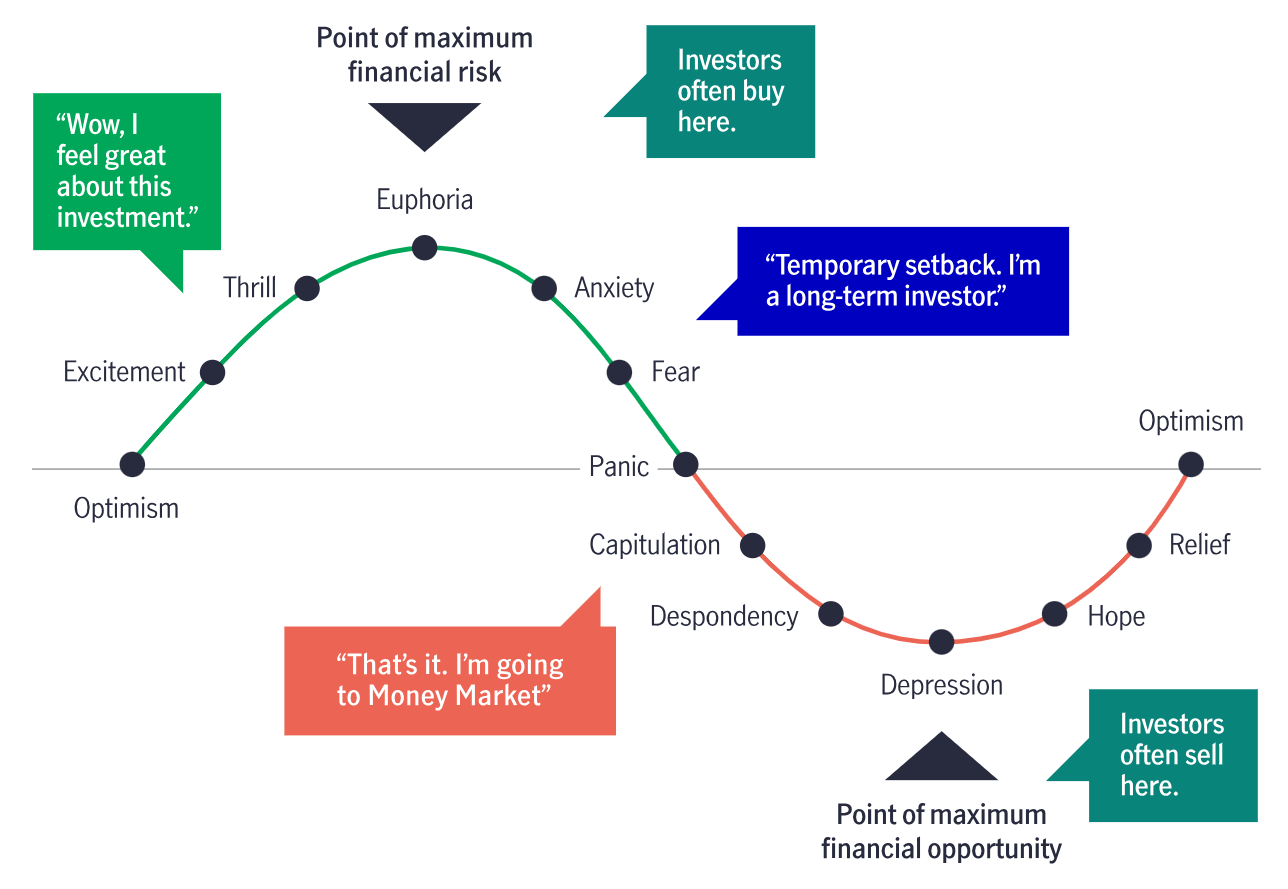

2. Be Rational, Not Emotional

Investors often get excited during good times and want to invest more, which can lead to buying at high prices. Conversely, during market downturns, fear can drive investors to sell at low prices. Stay disciplined and stick to your long-term investment plan to avoid getting caught up in this emotional cycle.

An Investors Emotional Roller Coaster:

Source: Hays Advisory. This chart is an example and does not represent the performance of any actual investment. This is not meant as investment advice. For illustrative purposes only.

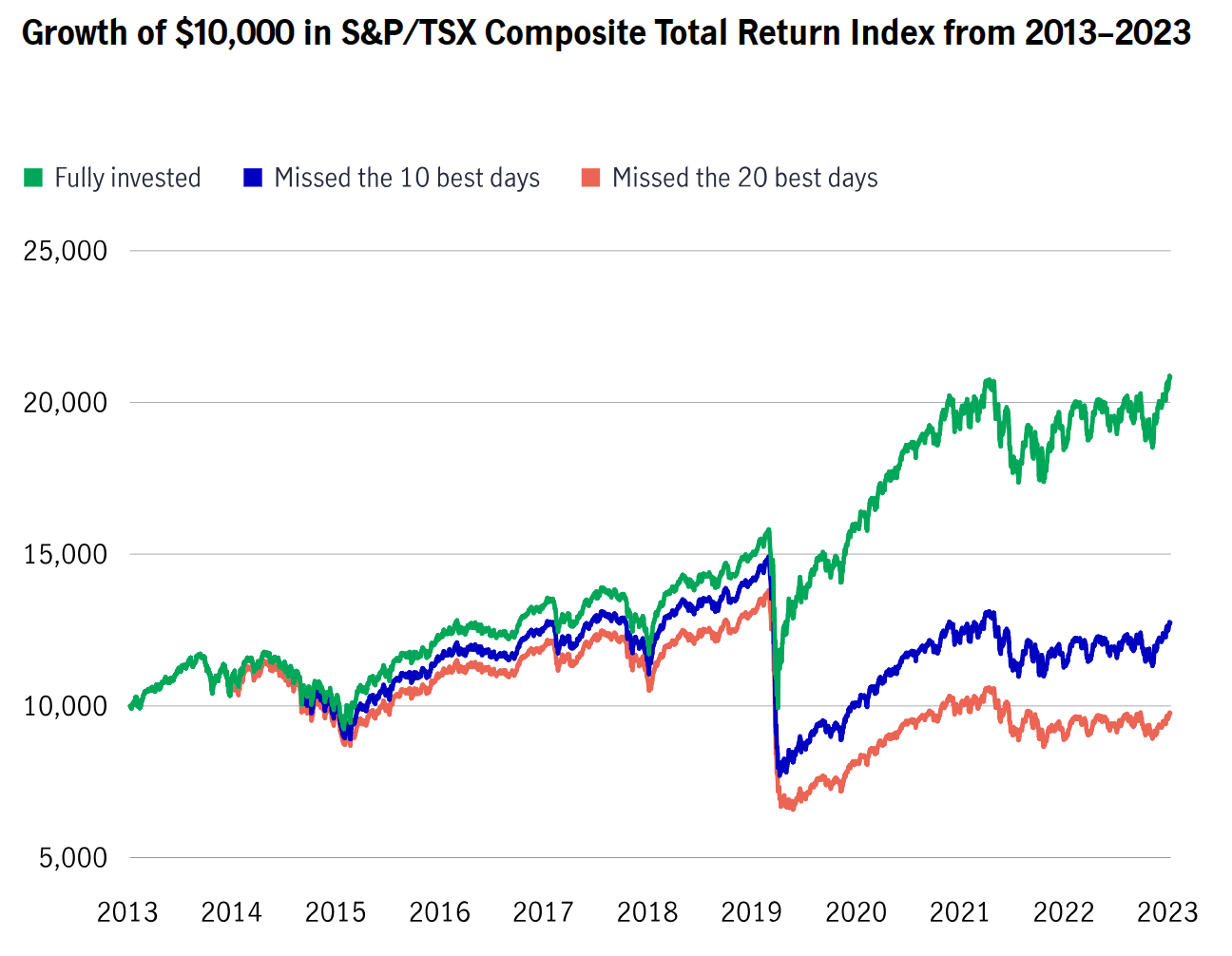

3. Don’t Miss Out on Key Opportunities

Investment success often hinges on being in the market during its best days. If you stay fully invested and don't miss the top 20 investment days over the past 20 years, your investments could more than double.

Source: Manulife Investment Management, Bloomberg, as of December 31, 2023. For illustrative purposes only. The index is unmanaged and cannot be purchased directly by investors. Past performance does not guarantee future results.

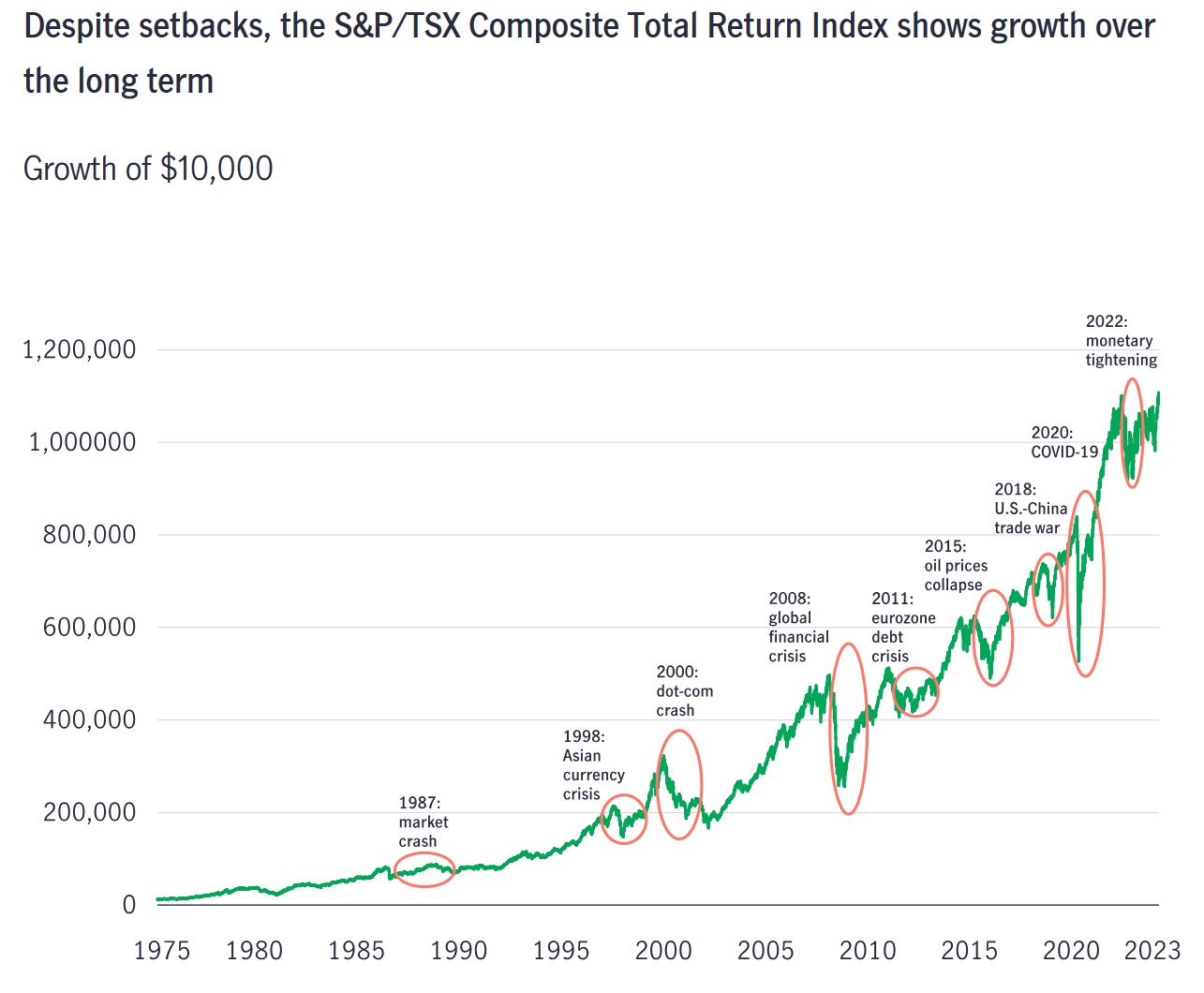

4. Look at Long-Term Performance

Understand that markets will fluctuate, but over the long term, they have historically trended upwards. Keeping a long-term perspective can help you stay the course through both crises and opportunities.

Source: Manulife Investment Management, Bloomberg, as of December 31, 2023. For illustrative purposes only. Red circles indicate periods of market decline. The index is unmanaged and cannot be purchased directly by investors. Past performance does not guarantee future performance.

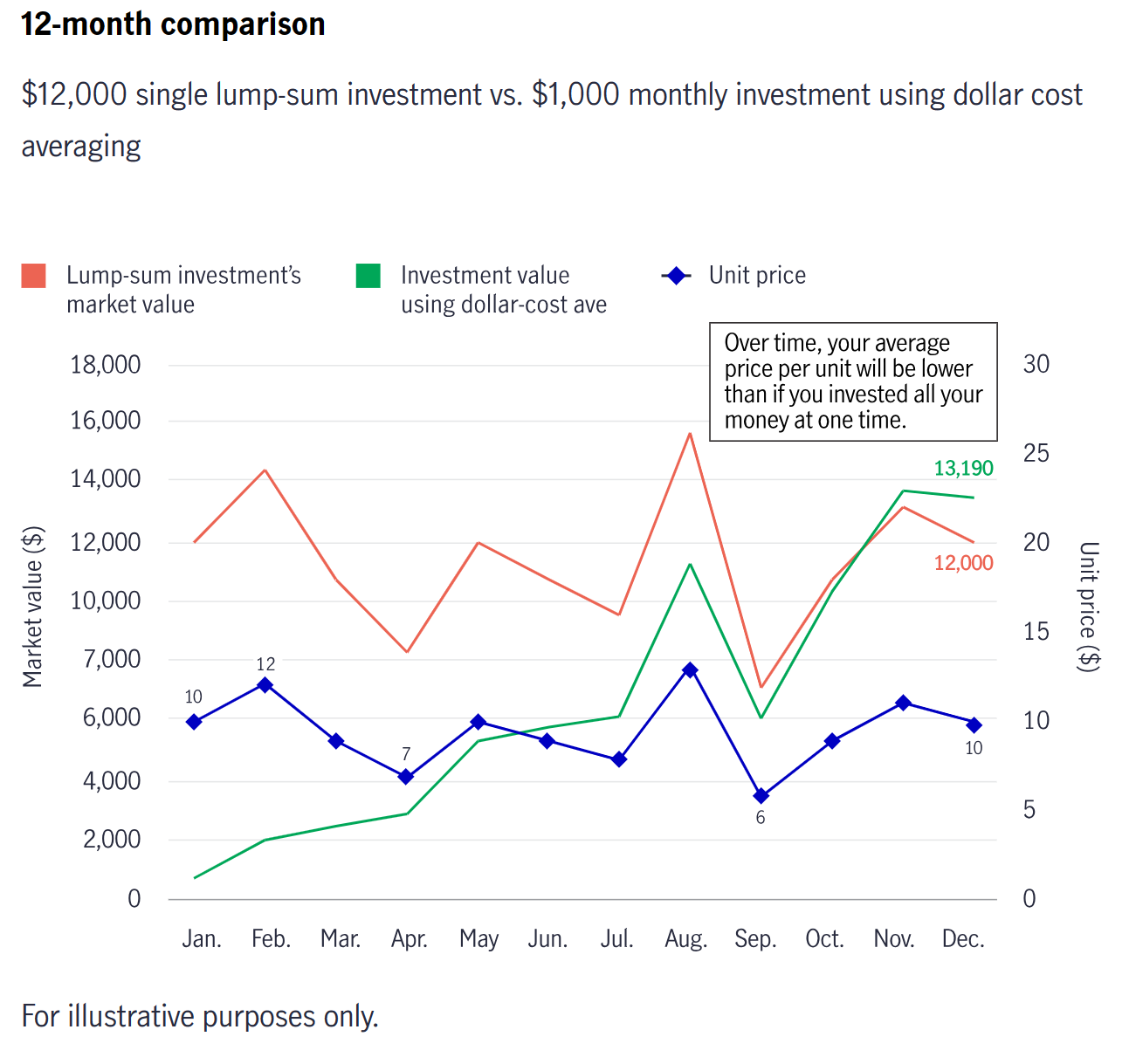

5. Use Market Volatility to Your Advantage

Investing a fixed amount at regular intervals, known as dollar-cost averaging, can help you buy more units when prices are low and fewer when prices are high. This strategy can alleviate the stress of trying to time the market perfectly with a lump-sum investment.

By incorporating these principles into your investment strategy, you can navigate volatile times with greater confidence and focus on achieving your long-term financial goals.

Source: https://www.manulifeim.com/retail/ca/en/viewpoints/investor-education/five-timeless-principles-for-investing-success