This commentary is compliments of Manulife Investments -

2024 starts with a bang!

Global markets stormed out of the gate in the first three months of 2024. The combination of a resilient consumer base and lower inflation levels created a positive backdrop for investors. The S&P 500 Index, the S&P/TSX Composite Index, and the MSCI World Index were up 10.2%, 5.8% and 8.4%, respectively, in Q1. The euphoria, however, didn't extend to the fixed-income space—Canadian and U.S. bonds (measured by the FTSE Canada Universe Bond Index and Bloomberg U.S. Aggregate Bond Index) were down 1.2% and 0.8%.

In our view, equities are priced for the best case scenario, with markets expecting to avoid a recession, on the belief that we’ll see a gradual decline in inflation, and that central banks will soon start cutting interest rates. In such an environment, any headline surprises that state otherwise may create potentially choppy markets in the near term.

How do stocks and bonds perform when the government begins to cut rates?

Investors have been waiting in anticipation for the U.S. Federal Reserve (Fed) to start cutting interest rates. They believe that lower interest rates will help drive the markets even higher. That said, history suggests things may not be quite as simple.

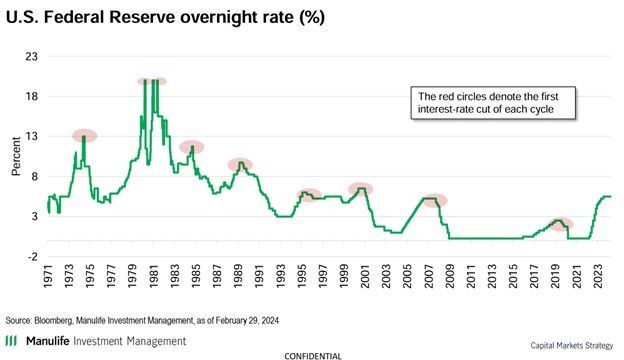

We looked at the previous nine easing cycles, dating back to 1970. In the first chart, we’ve indicated (in red) periods that we believe to mark the beginning of an easing cycle. These are easily identifiable in recent easing cycles; however, those in the early 1980s aren’t and require subjective interpretation.

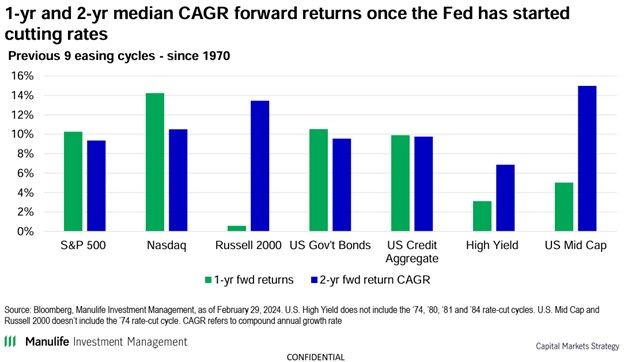

The second chart shows the one- and two-year forward returns for various asset classes from the first rate cut of each cycle. Generally speaking, investors were rewarded in both timeframes. Certain assets, however, including those represented by the Russell 2000 Index, U.S. High Yield Index, and the Russell Midcap Index, posted strong gains in the second year while experiencing choppiness in the first year.

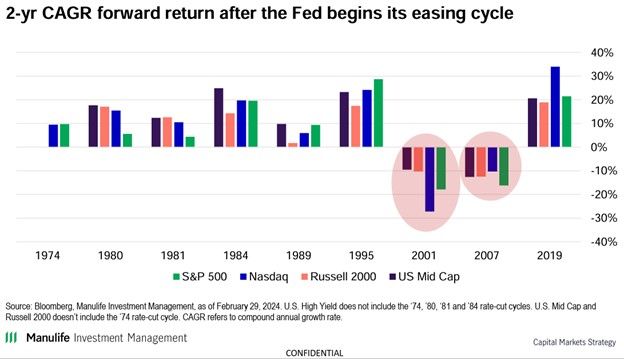

But wait, not all rate-cutting cycles are identical: If you were to look at the third chart closely, you should be able to see two distinct return profiles. Generally speaking, returns were favorable once the Fed began cutting rates with 2001 and 2007 being exceptions.

Overall, it’s fair to say that the Fed’s rate-easing cycles were in sync with the flow of the natural economic cycle. However, the circumstances in 2007 and 2001 were unique: In 2001, the context around the Fed’s rate cuts included a stock market bubble, a recession, and 9/11; in 2007, the backdrop was framed by the global financial crisis.

Today, our base case is that the Fed will likely cut rates later in the year amid what we believe to be a traditional economic cycle. Against that backdrop, investor returns will likely be positive moving forward. However, if something unexpected emerges, investors would be better served by proceeding with care.

Source: Manulife Investments Management, 2024 Q2 Macro & Markets Outlook