August 2023

The markets, in particular, the US have had a very good 2023.

At the end of August 18, the S&P 500 Index was up 14% year-to-date, driven higher mostly by the optimism surrounding the impact of artificial intelligence. However, if you take out the top 10 companies in the index, the S&P 500 return falls to roughly 5% year to date.

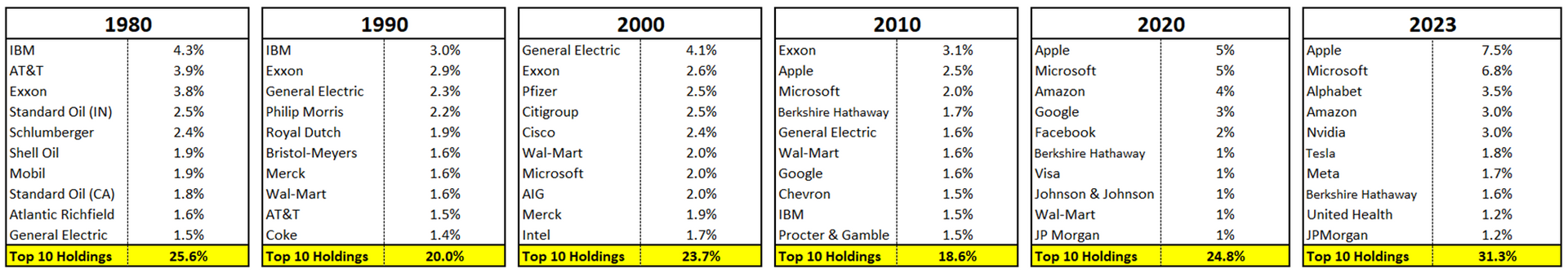

As a result, the top 10 companies in the S&P 500 now account for 30% of the index. This is the first time in modern history that the top 10 holdings account for 30% of the entire S&P 500.

While this stat in itself isn’t surprising. (There are many reasons that may justify the current high values including that we are likely getting close to peak interest rates and these companies have had better-than-expected quarterly earnings). We should be thoughtful of the risks.

Here is a chart showing the % companies and their % weight in the S&P500 over the past several decades

Historical Top 10 Holdings for the S&P 500 (% Index Weight)

Source: Bloomberg, as of July 31, 2023.

Some questions to consider:

- What is my exposure to these top 10 companies?

- What’s my current exposure today when looking at all my investments?

- Am I comfortable with this amount of exposure purely from a risk management perspective?

How each person reacts to the finding of these results will vary, as will their decision on how to react. It’s a good time to review portfolio positioning and make sure that there aren’t any unintended risks, given the concentration in returns this year.

Here are the overall results year to date:

| Index | YTD |

|---|---|

| TSX/S&P (Canada) | 2.04% |

| S&P 500 | 13.96% |

If you have any questions, feel free to reach out.

Source: www.marketwatch.com