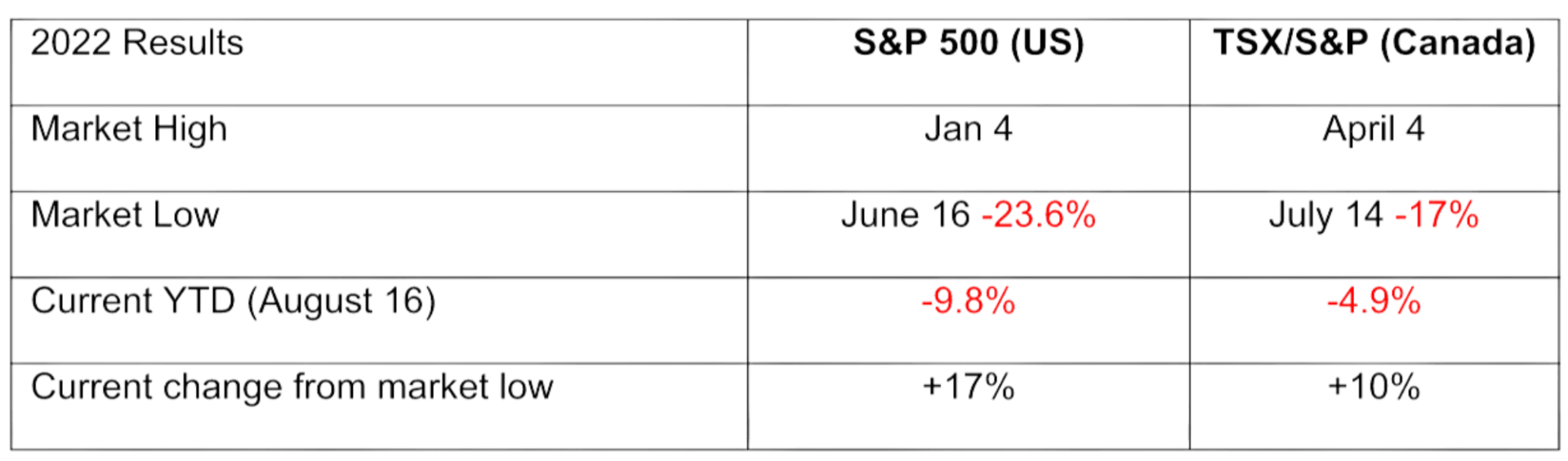

This summer has been a lot better for markets – the question is this the start of another bull market, or a rally during a bear market? Only time will tell.

Here are the latest predictions by Manulife’s Chief investment Strategists:

Not all bear markets are equal—there are big bears and baby bears, and market performance can vary widely for each type.

- A bear market is defined as a decline of 20% or more from the most recent peak. As of the time of writing, we’re in or near a bear market in many equity markets around the world. In the U.S., there’ve been 15 bear markets for the S&P 500 Index since the 1950s. For our discussion purposes, we‘ve included drawdowns of 19% or more as bear markets and have classified them into two buckets: big bears and baby bears. A baby bear means a bear market outside of a recession, while a big bear is a bear market that occurs in a recessionary environment.

- For the 15 bear markets since 1950, eight classify as big bears, while seven of them classify as baby bears. The baby bears have been more gentle to investors, with an average selloff of approximately 23%. Investors’ experience with big bears hasn’t been as kind, with the average selloff of approximately 37%

- Should we get a recession, our expectation is that it’ll be mild, supported by a solid employment environment and stable U.S. consumer. We believe the odds of a deep recession over the next 12 months remain low, and we’re unlikely to witness an environment similar to the great financial crisis (GDP decline of 5.1% and market drop of 57%); the 1973–1974 recession (GDP decline of 3.2% and a market drop of 48%); or the dot-com crash, where although we experienced only a mild recession, it was a result of an unprecedented tech bubble crash and the September 11 terrorist attacks (the S&P 500 dropped 49%). If we remove these three instances, the average 37% selloff of a big bear falls to 28%. If we’re correct, it would seem that the market has already priced in much of the downside risk.

History suggests that the first half performance that we’ve experienced this year may be unlikely to be replicated in the second half of the year.

- Since 1960, there were only two years (1962 and 1970) where the first half (H1) of the year saw a decline greater than 20% in the S&P 500 Index. Returns in the second half (H2) for those periods were 15% and 27%, respectively.

- In 21 of 62 first halves of the year (~34% of the time) since 1960, the returns were negative and the average return in H2 was 2%. If you remove the returns from the 1973–1974 recession, the dot-com crash, and the great financial crisis of 2008, the average return for the second half of the year was approximately 8.5%.

- We believe the odds of a deep recession over the next 12 months remain low. If we’re proven correct, the second half of 2022 should be much brighter than the first for equity investors.