Let's dive into May’s action: U.S. equity indices rebounded from April's losses, and treasury yields dropped. However, on the economic front, the job market softened, and inflation stayed above the Fed's 2% target.

May 2024 Market Summary: Equities Rebound, Persistent Inflation, and Lower Long-Term

Treasury Yields

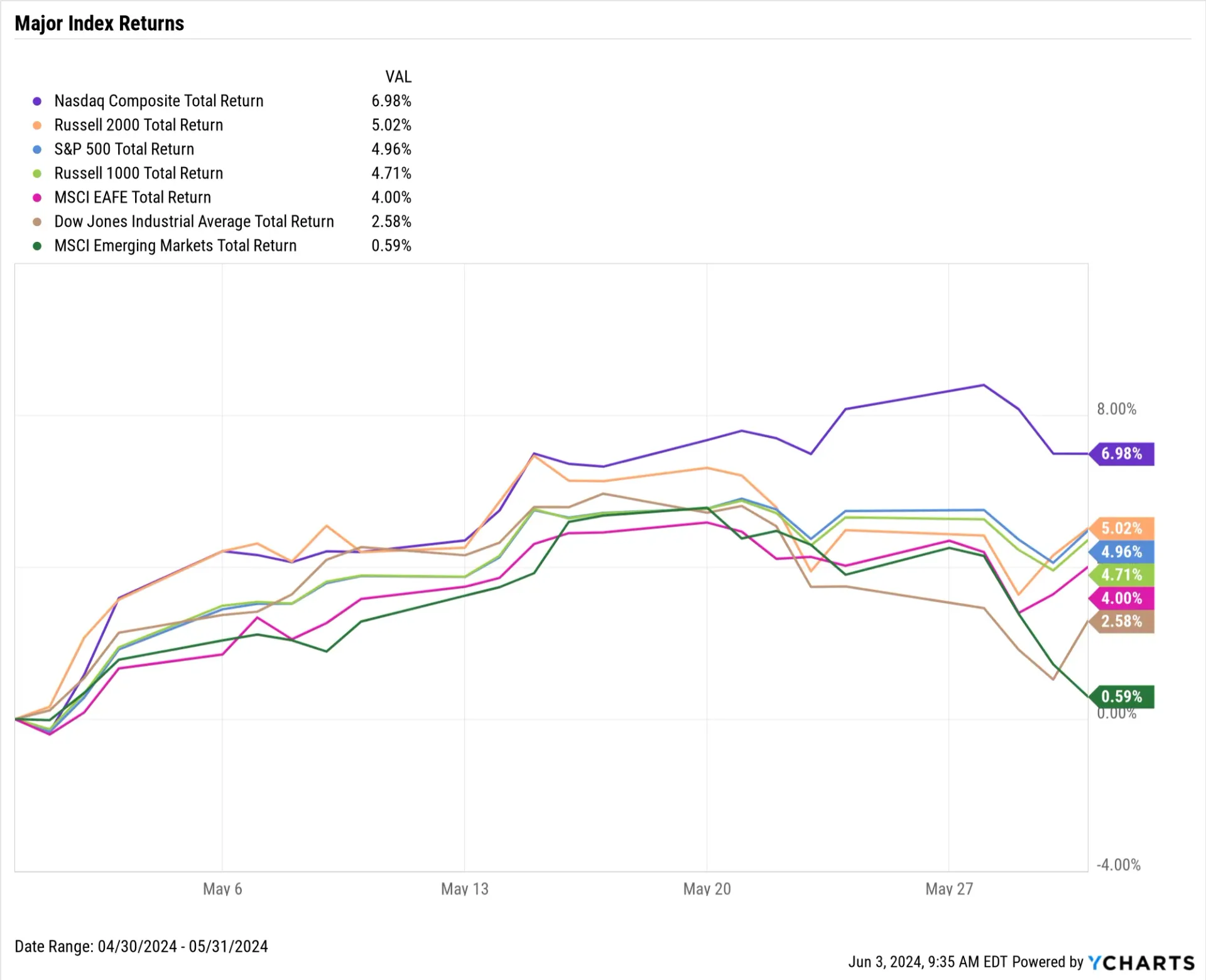

After a rough April that interrupted a three-month winning streak, equities bounced back in May. The Dow Jones Industrial Average climbed 2.6%, the S&P 500 jumped 5%, and the NASDAQ soared 7%. International stocks (EAFE) were up 4%, and Small Caps edged out Large Caps by 0.3%.

Utilities led the way for the second month in a row, leaping 9% in May. Technology and Communication Services also had strong performances, gaining 7.1% and 7%, respectively. The only sector to take a hit was Energy, which dipped 0.3%.

Equity Performance

In May, we saw both new single-family home sales and existing home sales take a dip. Meanwhile, the median price for existing homes climbed above $400,000. Inflation stayed in the mid-three percent range for the tenth month straight, and the U.S. Producer Price Index (PPI) rose to 2.17%. The unemployment rate inched up to 3.9%, and April's job gains were the lowest in seven months.

Economic Data

Yields on mid- to long-term Treasury bonds dropped in May, while T-Bill instruments saw little change. The 5-year Treasury note had the biggest movement on the curve for the second month in a row, falling by 20 basis points. Other durations, including the 2-year, 3-year, 10-year, 20-year, and 30-year, also saw decreases in double-digit basis points. The yields on 1-month and 3-month T-Bills remained steady.

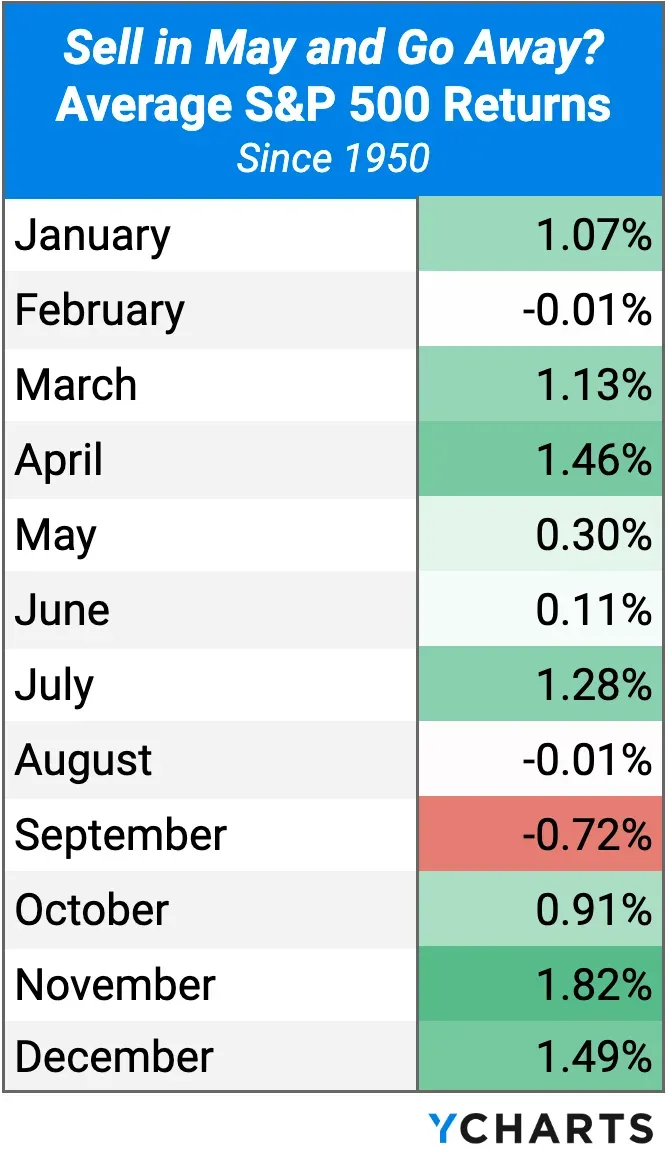

Off the Charts! Sell in May and Go Away?

You've probably heard the old stock market saying, “Sell in May and Go Away.” This strategy suggests that investors should pull their money out of the market in May to avoid the traditionally weaker performance from May to October.

But how accurate is this advice? Does staying out of the market during these months help or hurt long-term returns? We dug into the data to see if “Sell in May and Go Away” holds any weight.

Here’s a table showing the average S&P 500 returns for each month since 1950:

While it's true that the months from May to October have historically shown lower stock market returns compared to November through April, selling in May and moving to cash for six months each year has resulted in significantly lower annualized returns over the long term. This is mainly because spending less time in the market means missing out on potential gains during those months.

Equity Performance: Stocks Rebound Across the Board

Economic Data Overview: Inflation Persists, Home Sales Decline While Values Rise

Employment and April Economic Data Overview

Employment

April saw the unemployment rate rise slightly to 3.9%, with the labor force participation rate holding steady at 62.7%. Nonfarm payrolls added 175,000 new jobs, the lowest since October 2023 and below the anticipated 243,000.

Consumers and Inflation

U.S. inflation in April was 3.36%, marking the tenth month in the 3-4% range year-over-year (YoY). Core inflation dropped to 3.61%, the lowest since May 2021. The monthly Consumer Price Index (CPI) rose by 0.31%, and personal spending saw a modest increase of 0.20%. The Fed Funds Rate remained unchanged at 5.50% after the latest FOMC meeting on May 1st, 2024.

Production and Sales

The U.S. ISM Manufacturing PMI fell to 48.70 in May, slipping further into contraction territory after a brief expansion in March. The Producer Price Index (PPI) for April rose to 2.17%, marking its first time above 2% since April 2023 and its third consecutive monthly increase. U.S. Retail and Food Services Sales were flat month-over-month (MoM).

Housing

New single-family home sales dropped 4.7% in April, while existing home sales declined 1.9% MoM. Despite the decrease in demand, the median sales price of existing homes rose 3.7% to $407,600. Mortgage rates saw a slight decline in May, with the 15-year mortgage rate at 6.36% and the 30-year mortgage rate at 7.03%.

Commodities

Gold prices inched up to $2,348.30 per ounce by May 31st. Crude oil prices fell, with WTI down 3.1% to $80.90 per barrel and Brent down 7.8% to $81.34 per barrel. Consequently, the average price of gasoline dropped by 8 cents to $3.70 per gallon.

Cryptocurrencies

Cryptocurrencies bounced back in May. Bitcoin increased by 7.2% to $68,372, and Ethereum surged 16.7% to $3,749. Year-to-date, Bitcoin is up 61.9%, and Ethereum has risen 63.4%.

Source: https://get.ycharts.com/resources/blog/monthly-market-wrap/